What will the weather be tomorrow?

Deterministic vs probabilistic models

Published by Donata Petrelli on 23/07/2021

Image credits by Nicole Wilcox on Unsplash

Reading Time: 3 minutes

To predict the future has always been one of man’s greatest desires. Knowing what the weather will be like tomorrow, what the price of a certain financial asset will be but also which decollete will be in fashion next season, allow us to better plan our activities, reduce risks, safeguard our well-being and obtain benefits.

Although there is no certain method of prediction, it is possible to use scientific approaches to make estimates of future values assumed by those variables that represent the phenomenon we want to analyze. But which ones are they? And, above all, which to use?

The decision models on which forecasting analyses are based can be divided into two types: deterministic and probabilistic models. Depending on the nature of the problem to be analyzed and, therefore, the type of data, we can choose the optimal one.

The substantial difference lies in the fact that, while in deterministic models the initial data and the forces acting on it are known a priori for which it is assumed to identify with precision the evolution of the phenomenon, instead probabilistic models take into account the variations of the input variables, and therefore provide “probable” results.

The deterministic approach assumes a certain simplification of reality that is subject to random and unexpected events (black swan article). For this reason stochastic models are considered more reliable because they are more adherent to reality. Often it is useful to consider as first approach a deterministic model in order then to extend the first results to probabilistic cases.

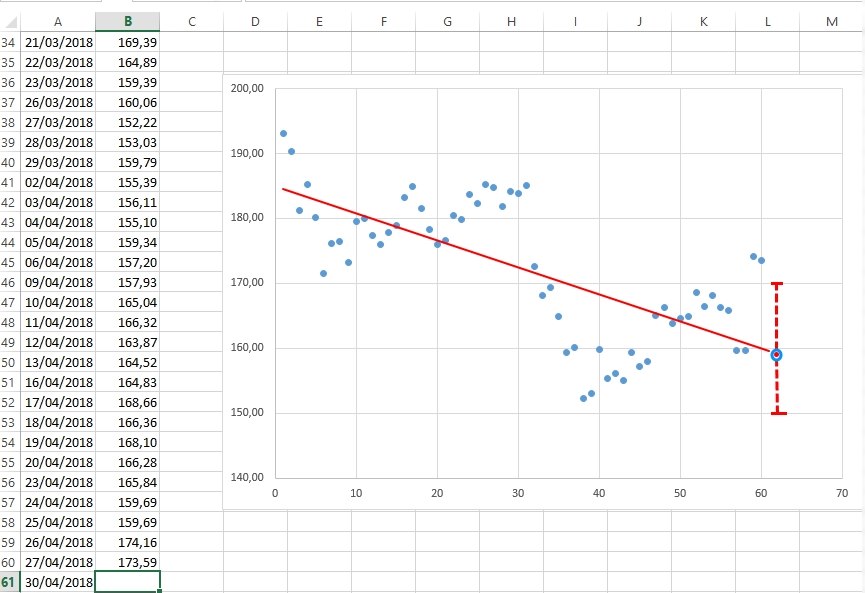

Let’s take an example and use these two paradigms in the area of financial markets. In our example we collect data from the closing prices of an asset and try to reason about how to get the estimate of the next price value.

For the purely descriptive purpose of this article, we want to make a simplification and conduct our visual analysis, via the asset’s chart.

In the case of a deterministic approach the situation that arises is that represented in Figure 1:

Applying the regression model, the price movement, which shows a downward trend indicated by the slope of the trend line, appears to be predetermined. The logic that is followed is that one of the linear regression for which, given a series of values, the next will be calculated through the resolution of an equation with a residual part.

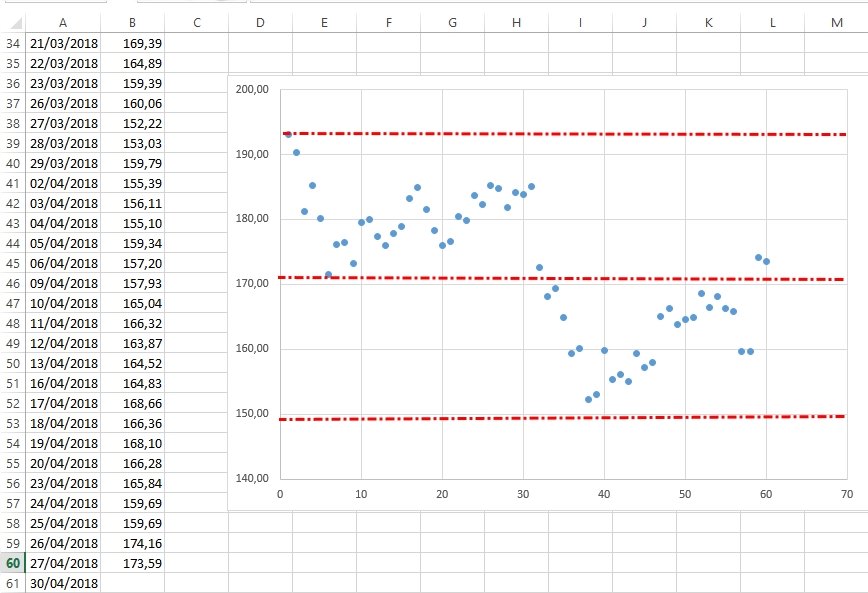

Let’s change approach and follow instead the probabilistic logic. In this case the values of the prices are not more bound to move along a curve and, as such, they are not already “predestined” to a trend but they can assume a value following criteria completely probabilistic. The situation is represented in Figure 2:

In the second case, once those price intervals with their relative frequencies have been identified, the next price will be free to fall into any preliminarily found interval.

This short article aims to provide a different approach to the study and forecasting analysis of data. With this example we have only shown how, depending on the approach used, different results are obtained and gradually more adherent to reality. Only with the subsequent application of AI and ML methods it is possible to obtain more accurate numerical estimates.

Published with licenza CC BY-NC-ND 3.0 IT (Creative Common – Attribuzione – Non commerciale – Non opere derivate 3.0 Italia)